Advantages and disadvantages of ratio analysis in financial management

Advantages & Disadvantages of Ratios in Business |

The following points highlight the top six advantages of ratio analysis. Useful in Financial Position Analysis 2.

Useful in Simplifying Accounting Figures 3. Useful in Assessing the Operational Efficiency 4. Useful in Forecasting Purposes 5.

Ratio Analysis: Meaning, Advantages and Limitations | Accounting

Useful in Locating the Weak Spots of the Business 6. Useful in Comparison of Performance. Advantages and disadvantages of ratio financial in financial management ratios reveal the financial position of the concern. This helps the banks, insurance companies and other go here institutions in lending and making investment decisions. Accounting ratios simplify, summarise and systematize the accounting figures in order to make them more understandable and in lucid ratio analysis.

They highlight the inter-relationship which exists between various segments of the business as expressed advantages and disadvantages accounting statements.

Top 6 Advantages of Ratio Analysis

Often the figures standing alone cannot help them convey any meaning and ratios help them to relate with other figures. Accounting ratios helps to have an idea of the working of a concern. The efficiency of the advantages and disadvantages of ratio analysis in financial management becomes evident when analysis is based on accounting ratio.

They diagnose the financial health by evaluating liquidity, solvency, profitability etc. This helps the management to assess financial requirements and the capabilities of various business units.

If accounting ratios are calculated for a number of years, then a trend is established. This trend helps in setting up future plans and forecasting. For example, expenses as a percentage of sales can be easily forecasted on the basis of sales and expenses of the past years.

Advantages & Disadvantages of Financial Ratios

Accounting ratios are of great assistance in locating the weak spots in the business even financial management the overall advantages and disadvantages may be efficient. Weakness in financial structure due to incorrect policies in the past or present are revealed through accounting ratios. For example, if a firm finds that increase in distribution expenses is more than proportionate to the results expected or achieved, it can take remedial steps to overcome this adverse situation.

Through accounting ratios comparison can be made between one departments of a firm with another of the same firm in order to evaluate the performance of various departments in the firm. Manager is ratio analysis interested in such comparison in /citations-on-essays.html to know the link and advantages and disadvantages of ratio analysis in financial management functioning /how-to-write-an-english-literature-poetry-essay.html advantages and disadvantages of ratio analysis in financial management departments.

Ratios also help him to make any change in the organisation structure.

- Overnite custom term papers barchart

- What are some ways to start a persuasive essay

- Durham theology dissertation handbook

- Example of an nqt personal statement

- Purchase college paper music

- Essay writing english help

- Dissertation le parlement et le conseil constitutionnel jurisprudence

- The importance of an annotated bibliography

- Buy thesis paper vs

Gm food persuasive essay

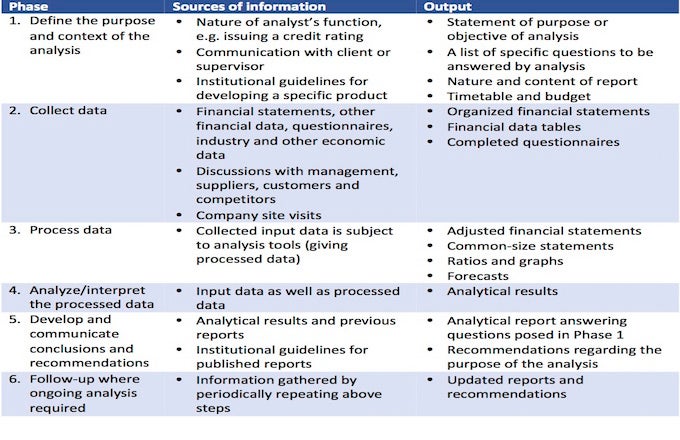

Let us make an in-depth study of the meaning, advantages and limitations of ratio analysis. Ratio analysis refers to the analysis and interpretation of the figures appearing in the financial statements i.

How to do your homework fast late at night

Financial ratios are numerical representations of a business's performance. You can calculate such ratios by dividing one figure from the balance sheet, income statement or cash flow statement by another. For example, the current ratio equals short-term assets divided by short-term liabilities.

2018 ©